From an early-stage Kickstarter sensation, Larq has developed into a hydration technology company with remarkable efficacy. Its success story exemplifies not only innovation but also perseverance, accuracy, and cultural timing. This California-based business was founded in 2017 by Douglas Collins and Justin Wang, two businessmen with very different but complementary backgrounds. Collins contributed highly technical knowledge rooted in LED innovation, while Wang brought aesthetic instincts refined during his tenure at luxury-tech company FOREO.

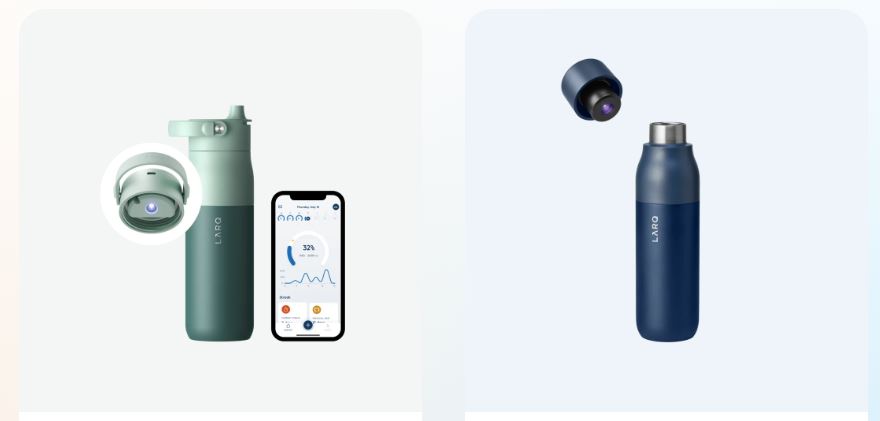

From the release of its first product in 2018, a sleek, self-cleaning bottle with UV-C LED purification, Larsq managed to combine minimalist design with scientific performance. The device was extremely versatile, neutralizing odors and killing up to 99.9999% of bacteria and viruses. Beyond the specifications, however, the bottle exuded an aspirational, even artistic, vibe that reflected the growing desire for smarter, cleaner living.

Larq Company Overview and Financial Summary

| Company Name | LARQ, Inc. |

|---|---|

| Founded | 2017 |

| Headquarters | San Mateo, California, USA |

| Founders | Justin Wang, Douglas Collins |

| Industry | Smart Hydration, Consumer Products, E-Commerce |

| Flagship Products | LARQ Bottle, LARQ Pitcher |

| Acquisition | Acquired by BRITA in February 2024 |

| Valuation Estimate | $50 million (based on Shark Tank appearance, 2021) |

| Projected Revenue | $30 million (2022 estimate) |

| Total Funding Raised | $15.6 million (across crowdfunding, VC, and Series A) |

| Website | www.livelarq.com |

In 2021, Wang made the audacious decision to appear on Shark Tank with one of the highest valuations in the program’s history. He shocked the panel by asking for $500,000 even though he only had 1% equity. After presenting Larq’s sales figures, which were $5.5 million in the first year and $14 million in the third, Wang’s argument gained traction. His confident defense of the valuation impressed the audience. By the end of the segment, Lori Greiner and Kevin O’Leary had contributed $1 million to the company in exchange for a small 4% equity stake. This agreement immediately established Larq as a standard for high-end hydration technology.

Larq’s revenue trajectory has significantly improved since that episode aired. The company’s second flagship product, the LARQ Pitcher, was the main driver of its projected $30 million in revenue in 2022 alone. This product was more than just a more attractive Brita substitute. It introduced a two-stage filtration system that can remove pollutants that other pitchers tend to overlook, such as pesticides, heavy metals, and arsenic. More intriguingly, the pitcher linked to a smartphone app that monitored hydration objectives, demonstrating a particularly creative combination of software and hardware in a generally disregarded area.

Due to the company’s accomplishments, acquisition offers were made by 2024, and Larq eventually became a part of the BRITA portfolio. Analysts close to the transaction estimate that Larq’s valuation at the time probably exceeded $50 million, even though the acquisition’s terms are still confidential. This change was a significant turning point. Joining an industry giant like BRITA validated years of unrelenting product development, consumer outreach, and brand storytelling for a startup that had begun with napkin sketches and a Kickstarter page.

In addition to flourishing on direct-to-consumer platforms, Larq’s products have found homes in upscale stores like Nordstrom and MoMA in recent years. Larq established a highly effective revenue pipeline, reducing overhead and strengthening customer relationships, with more than 70% of sales coming directly from online customers. Since drinking water is a daily habit, Wang frequently highlights the brand’s emotional appeal. And customers participate with unexpected loyalty when that ritual is made cleaner, smarter, and more attractive.

Early 2025 financial indicators indicate both opportunity and difficulty. The company reported an EBITDA of about -$4.1 million, indicating continued reinvestment in marketing and innovation, while gross profits were just over $429,000. Although net losses of about $5.5 million suggest aggressive scaling, the company’s free cash flow position, which has surpassed $63 million, is a clear indication that its operational model is sustainable. With more than 49% of shares still held by insiders, shareholding metrics further highlight a dedicated founding team and long-term alignment.

The brand’s quick ascent has also been fueled by its cultural relevance. Discussions about sustainable practices, hygiene, and wellness became particularly pressing during the pandemic. Larq’s dedication to sustainability—removing plastic waste, providing materials free of BPA and phthalates, and encouraging reusability—resonated especially well. It evolved from a simple water bottle to a representation of purposeful living. Consumers frequently characterized their experience as surprisingly transforming, and many of them wrote positive reviews. It’s “the best tasting water I’ve ever had from a bottle,” according to one verified customer, and “a conversation starter that never stops,” according to another.